Business

China warns countries against making trade deals with the US unfavorable to Beijing

-

Latest News23 hours ago

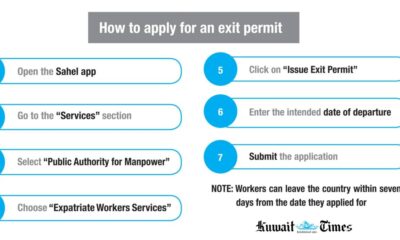

Latest News23 hours agoExit permit now mandatory for expat workers

-

Latest News18 hours ago

Latest News18 hours agoAFESD, AIIB sign deal to boost sustainable infrastructure projects

-

Latest News17 hours ago

Latest News17 hours agoFootball academies shaping future stars, instilling core values

-

Latest News15 hours ago

Latest News15 hours agoZain celebrates Kuwait’s promising talents at annual top students honoring ceremony

-

Latest News21 hours ago

Latest News21 hours agoIran Embassy opens condolence book to honor victims of Zionist aggression

-

Latest News19 hours ago

Latest News19 hours agoKuwait aims to turn ACD forum into international organization

-

Politics16 hours ago

Politics16 hours agoKuwaiti Convicted Of Using a Fake High School Diploma To Secure Govt Job

-

Politics15 hours ago

Politics15 hours agoTimely Action Prevents Casualties in Al-Wafra Warehouse Fire