Business

Gold discounts widen in India as high prices weaken demand

-

Latest News20 hours ago

Latest News20 hours agoKuwait revives co-op Kuwaitization plan with new online hiring system

-

Politics13 hours ago

Politics13 hours agoExpat Caught Sneaking In Chewing Tobacco at Kuwait Airport

-

Latest News13 hours ago

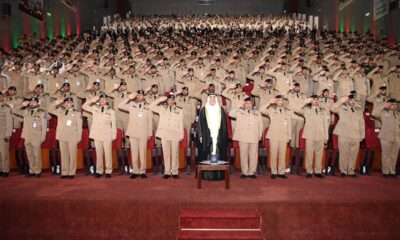

Latest News13 hours agoFrist Deputy PM attends new batch graduation of officers

-

Latest News23 hours ago

Latest News23 hours agoKuwait’s sovereign wealth fund maintains fifth place globally

-

Latest News12 hours ago

Latest News12 hours agoKuwait signs landmark health deals with top French hospitals

-

Business23 hours ago

Business23 hours agoKNPC expands Mina Al-Ahmadi & Mina Abdullah refinery capacities

-

Business22 hours ago

Business22 hours ago41% of Kuwaiti startups are now led by women, the highest in the Gulf

-

Latest News21 hours ago

Latest News21 hours agoPAFN seizes 10 tons of spoiled seafood at Sharq fish market