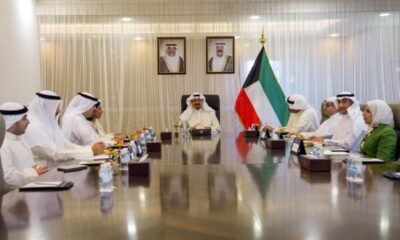

KUWAIT CITY, Aug 06: Kuwait Credit Information Network Company (CINET) participated in the 19th meeting of the Arab Committee on Credit Information, organized by the Arab Monetary Fund. The event brought together leaders in the credit information industry across the region to discuss current challenges and best practices in credit reporting and scoring services. CINET’s participation highlighted how it utilizes data science and artificial intelligence in credit evaluation and risk management, offering valuable insights into the role of data analytics in enhancing institutional decision-making.

Representing CINET at the event were Mrs. Mai Bader Al-Owaish, Chief Executive Officer, and Mr. Fouzan Y. Al-Sumait, Senior Manager of Data and Artificial Intelligence. They delivered a specialized presentation outlining CINET’s experience in data science and analytics, showcasing innovative products that embed advanced analytics into credit information services and demonstrating their impact on financial decision-making and credit stability.

CINET is the first credit company in the region to apply this integrated model, underscoring its leadership in leveraging technology to enhance the efficiency of the financial market. The company continues its efforts to deliver advanced solutions, including the recent launch of its new mobile application, which enables individuals to access their full credit facilities—including loans and credit cards, and more—in a transparent, fast, and user-friendly manner, empowering individuals and businesses with smarter financial decision-making tools and more effective risk management.

Commenting on the participation, Mrs. Mai B. Al-Owaish said:“Our participation in this meeting reaffirms CINET’s commitment to supporting the development of cutting-edge data solutions that address the evolving needs of financial institutions and provide both individuals and organizations with practical tools for accurate and smarter financial decision-making. This platform enables us to share experiences with our peers in the Arab region, highlight our success stories, and explore advanced tools that pave the way for a more data-driven and inclusive credit ecosystem”.

Mr. Fouzan Y. Al-Sumait added:“At CINET, we are keen to design data analytics tools that enable financial institutions to understand customer behavior and assess risks accurately, leveraging data science capabilities for strategic growth. We provide precise insights into creditworthiness, credit patterns, and risk exposure. From our experience with financial institutions in Kuwait that use CINET’s credit analytics products, it has become clear that effective data strategies is a critical factor in mitigating risks, enhancing financial stability, and achieving sustainable growth”.

The Arab Committee on Credit Information, whose secretariat is overseen by the Arab Monetary Fund, operates under the Arab Central Banks and Monetary Authorities’ Governors. It includes directors and officials from credit information units within Arab central banks and monetary authorities, along with executives from licensed national credit information companies.

CINET’s participation reflects its ongoing commitment to innovation and excellence and its vision to reshape the future of credit services in Kuwait and the region through actionable analytics, precision, and cutting-edge innovation.

Politics19 hours ago

Politics19 hours ago

Latest News20 hours ago

Latest News20 hours ago

Latest News18 hours ago

Latest News18 hours ago

Politics10 hours ago

Politics10 hours ago

Politics9 hours ago

Politics9 hours ago

Business10 hours ago

Business10 hours ago

Latest News10 hours ago

Latest News10 hours ago

Business8 hours ago

Business8 hours ago