BANGKOK, June 24, (AP: Stocks rallied and oil prices fell on Tuesday after U.S. President Donald Trump announced what appears to be a shaky ceasefire in the Israel-Iran war.

A tentative truce proposed by Trump remained uncertain after Israel said Iran had launched missiles into its airspace less than three hours after the ceasefire went into effect.

It vowed to retaliate. Still, investors took heart after Trump said Israel and Iran had agreed to a “complete and total ceasefire” soon after Iran launched limited missile attacks Monday on a U.S. military base in Qatar, retaliating for the American bombing of its nuclear sites over the weekend.

The future for the S&P 500 gained 0.8% while that for the Dow Jones Industrial Average was up 0.6%.

“The Middle East may still be smoldering, but as far as markets are concerned, the fire alarm has been shut off,” Stephen Innes of SPI Asset Management said in a commentary.

In early European trading, Germany’s DAX leaped 1.8% to 23,679.64, while the CAC 40 in Paris added 1.2% to 7,631.07. Britain’s FTSE 100 was up 0.4% at 8,789.91.

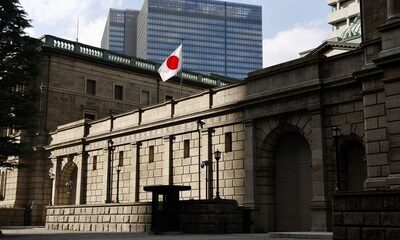

In Asia, Tokyo’s Nikkei 225 rose 1.1% to 38,790.56 and the Hang Seng in Hong Kong gained 2.1% to 24,177.07.

The Shanghai Composite index climbed 1.2% to 3,420.57. In South Korea, the Kospi jumped 3% to 3,103.64, while Australia’s S&P/ASX 200 gained 1% to 8,555.50. Taiwan’s Taiex rose 2.1% and India’s Sensex was up 0.6%. In Bangkok, the SET surged 2.5%.

Oil prices fell further, after tumbling on Monday as fears subsided of an Iranian blockade of the Strait of Hormuz, a vital waterway for shipping crude.

The price of oil initially jumped 6% after trading began Sunday night, a signal of rising worries as investors got their first chance to react to the U.S. bombings.

But it quickly shed all those gains, with U.S. benchmark crude falling 7.2%. It dropped further early Tuesday, giving up 2.4% to $66.85 per barrel. It had briefly topped $78. Brent crude, the international standard, shed 2.4% early Tuesday to $68.83.

U.S. stocks rallied on Monday despite the United States’ bunker-busting entry into its war with Israel. The S&P 500 climbed 1% and the Dow industrials gained 0.9%. The Nasdaq composite index advanced 0.9%.

Iran’s retaliation for the U.S. attacks appeared not to target the flow of oil. The fear throughout the Israel-Iran war has been that it could squeeze supplies, pumping up prices for crude, gasoline, and other products.

Back in the U.S., Treasury yields eased after a top Federal Reserve official said she would support cutting rates at the Fed’s next meeting, as long as “inflation pressures remain contained.”

Investors will be watching for Fed. Chair Jerome Powell’s comments to the U.S. Congress later Tuesday, analysts said. The yield on the 10-year Treasury held steady at 4.33% from 4.38% late Friday. The two-year Treasury yield, which more closely tracks expectations for the Fed, dropped to 3.83% from 3.90%.

The Federal Reserve has been hesitant to cut interest rates this year because it’s waiting to see how much higher tariffs imposed by Trump will hurt the U.S. economy and raise inflation. Inflation has remained relatively tame recently, but higher oil and gasoline prices would push it higher.

That could keep the Fed on hold because cuts to rates can fan inflation while they also give the economy a boost. On Wall Street, Elon Musk’s Tesla was the single strongest force pushing the S&P 500 higher after jumping 8.2%.

The electric-vehicle company began a test run on Sunday of a small squad of self-driving cabs in Austin, Texas. It’s something that Musk has long been touting and integral to Tesla’s stock price being as high as it is.

Hims & Hers Health tumbled 34.6% after Novo Nordisk said it will no longer work with the company to sell its popular Wegovy obesity drug. Novo Nordisk’s stock that trades in the United States fell 5.5%.

In currency dealings early Tuesday, the U.S. dollar fell to 145.44 Japanese yen from 146.15 yen late Monday. The euro rose to $1.1604 from $1.1578.

Latest News22 hours ago

Latest News22 hours ago

Business15 hours ago

Business15 hours ago

Politics8 hours ago

Politics8 hours ago

Latest News15 hours ago

Latest News15 hours ago

Latest News6 hours ago

Latest News6 hours ago

Latest News13 hours ago

Latest News13 hours ago

Politics5 hours ago

Politics5 hours ago

Latest News5 hours ago

Latest News5 hours ago