KUWAIT CITY, Apr 09: Following regulatory approvals and the Extraordinary General Assembly’s decision to increase the Bank’s capital by 100%, at a value amounting to KD 218,360,000 with an issuance premium of KD 218,360,000, Warba Bank has officially launched the electronic subscription phasein its capital increase.

This phase is open to shareholders whose names are registered in the Bank’s shareholder register with the Kuwait Clearing Company (Maqasa) as of April 9, 2025, to exercise their preemptive rights. The Bank is offering 2,183,600,000 (two billion, one hundred and eighty-three million, six hundred thousand) new shares at 200 fils per share, comprising 100 fils nominal value and 100 fils issuance premium, resulting in a total capital increase of KD 436,720,000.

Chief Executive Officer of Warba Bank, Shaheen Hamad Al-Ghanem, commented:“The anticipated capital increase represents a pivotal milestone in Warba Bank’s growth journey and a strategic step that supports our ambitious expansion plans and strengthens our position as a leading Islamic banking institution. Over the past years, Warba has achieved qualitative progress across various sectors, supported by a clear vision focused on innovation, digital transformation, and sustainability. Today, we open the door for our shareholders to be part of the next phase of this journey.”

He added:“This increase will enable us to strengthen our capital base and diversify our investments to meet our customers’ aspirations and generate sustainable value for shareholders. We recognize that our shareholders have always been partners in our continued success. With this step, we reaffirm our determination to implement our growth strategy, expand our banking services, and invest in the latest financial solutions that address future market demands. This opportunity invites every shareholder to take part in building a brighter tomorrow as we move forward together toward our shared vision.”

Al-Ghanem emphasized that the Bank is committed to streamlining the subscription process by offering it electronically, saving shareholders time and effort in line with Warba Bank’s digital development strategy aimed at providing flexible, accessible banking solutions.

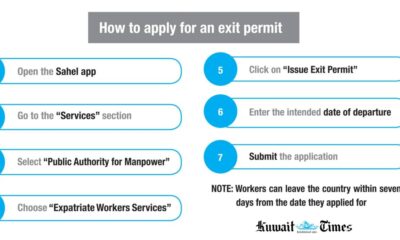

Shareholders must complete the subscription process directly via the dedicated website https://www.ipo.com.kw or through the IPO Kuwait application. Once registered, the system will determine their eligibility. Subscribers will then select the number of shares they wish to purchase and proceed with payment through the electronic payment system.

Al-Ghanem encouraged all shareholders and interested parties to review the subscription prospectus, which outlines the terms, conditionsand procedures of the offering. The prospectus is available on the Boursa Kuwait website as well as Warba Bank’s official website at www.warbabank.com.

He concluded by stating: “This capital increase is not merely a financial move. It is a reaffirmation of Warba Bank’s commitment to expansion and sustainable growth. We stand at the threshold of a new chapter of progress, ready to reinforce our leadership in the banking sector through strategic investments that foster innovation, improve customer experience, and deliver lasting value for shareholders. Together, we continue building a stronger, more stable future—guided by our ambitious vision and inspired by our promise: ‘We hear you, to own tomorrow.’”

Latest News23 hours ago

Latest News23 hours ago

Latest News17 hours ago

Latest News17 hours ago

Latest News18 hours ago

Latest News18 hours ago

Latest News15 hours ago

Latest News15 hours ago

Latest News21 hours ago

Latest News21 hours ago

Latest News19 hours ago

Latest News19 hours ago

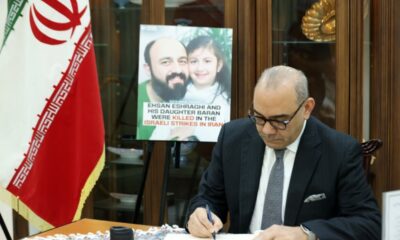

Politics16 hours ago

Politics16 hours ago

Politics15 hours ago

Politics15 hours ago