A currency trader reacts near a screen showing the Korea Composite Stock Price Index (KOSPI), (left), and the foreign exchange rate between US dollar and South Korean won at the foreign exchange dealing room of the Hana Bank headquarters in Seoul, South Korea, on July 21. (AP)

BANGKOK, July 21, (AP): Asian shares are mixed and US futures have edged higher after US stocks logged their third straight winning week. Markets were closed for a holiday in Japan, where the ruling Liberal Democrats have lost their coalition majorities in both houses of parliament for the first time since 1955 following Sunday’s election and the loss of their lower house majority in October.

A grim Prime Minister Shigeru Ishiba has vowed to stay on, but the outcome of the upper house election reflects voters’ frustration with rising prices and political instability. Analysts said they expect his weakened government to crank up spending, adding to Japan’s huge debt burden. Japan is also facing the imposition of 25% tariffs across the board on its exports to the US as talks with the Trump administration appear to have made little headway.

“We expect short-term political instability to intensify due to the difficulties of forming a majority coalition, a likely change in leadership, and a potential deadlock in trade negotiations,” Peter Hoflich of BMI, a part of the Fitch Group, said in a commentary. “Without a structural reset through snap elections, Japan is likely to face prolonged policy drift throughout 2026,” he said.

Chinese shares advanced after the central bank kept its key 1-year and 5-year loan prime interest rates unchanged. Hong Kong’s Hang Seng rose 0.6% to 24,977.18, while the Shanghai Composite index gained 0.7% to 3,559.79. Recent improved economic data have eased pressure on the Chinese leadership to soften credit.

Meanwhile, President Donald Trump’s administration has softened its criticism of Beijing, raising hopes that the two sides can work out a trade deal and avert the imposition of sharply higher tariffs on imports from China. South Korea’s Kospi picked up 0.7% to 3,210.81 after the government reported a slight improvement in exports in June. In Australia, the S&P/ASX 200 shed 1% to 8,668.20, while Taiwan’s Taiex dropped 0.2%.

In India, the Sensex rose 0.4%. Bangkok’s SET gained 0.2%. This week will bring updates on U.S. home sales, jobless claims and manufacturing. Several Big Tech companies including Alphabet and Tesla are due to provide earnings reports. On Friday, the S&P 500 handed back less than 1 point after setting an all-time high the day before. The Dow Jones Industrial Average fell 0.3% and the Nasdaq composite edged up by less than 0.1% to add its own record.

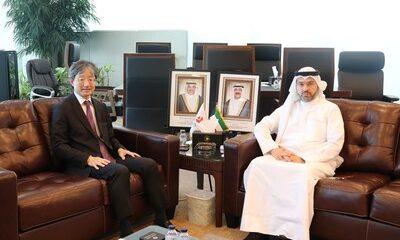

Business19 hours ago

Business19 hours ago

Politics17 hours ago

Politics17 hours ago

Latest News16 hours ago

Latest News16 hours ago

Latest News15 hours ago

Latest News15 hours ago

Politics19 hours ago

Politics19 hours ago

Latest News18 hours ago

Latest News18 hours ago

Latest News12 hours ago

Latest News12 hours ago

Latest News8 hours ago

Latest News8 hours ago