Walk into any café in Kuwait City today, and you are more likely to hear the beep of a phone than the rustle of dinars.

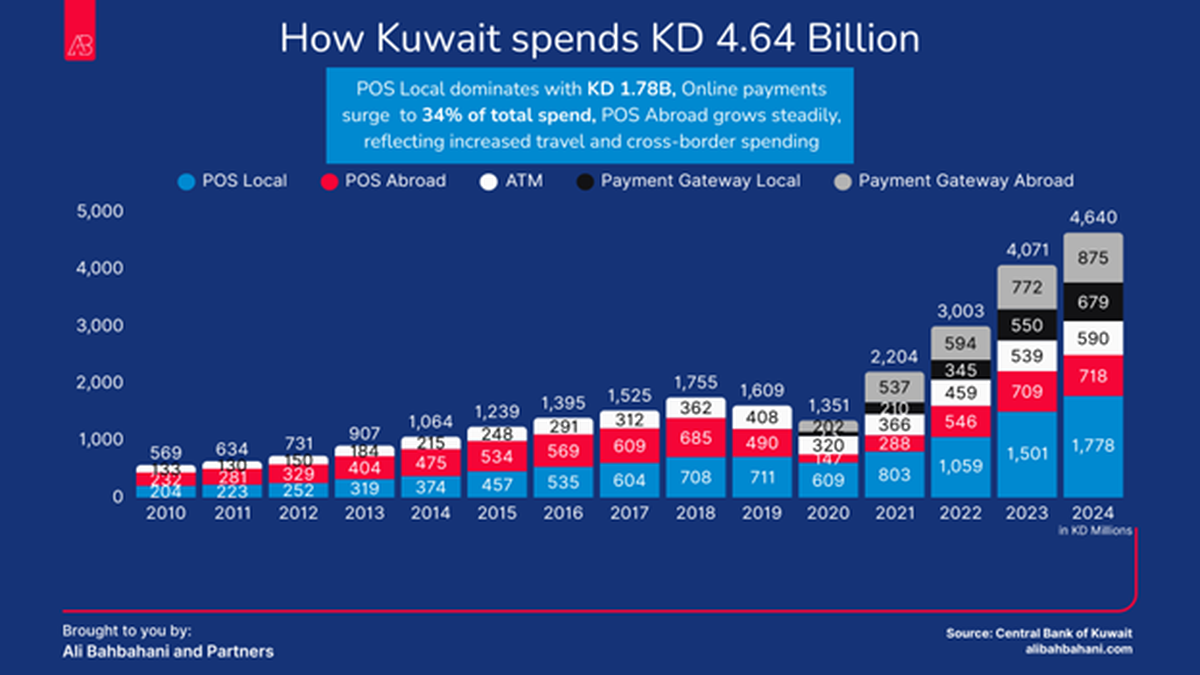

According to the Central Bank of Kuwait’s Payment Cards Statistics (2010-2024), card spending has increased from KD 569 million in 2010 to KD 4.64 billion in 2024, representing a 716 per cent rise, one of the fastest payment transformations in the Gulf.

The digital awakening

CBK data points to four forces converging at just the right moment:

Youth demographics drive change With more than 70 percent of Kuwaitis under forty, and smartphone penetration above 90 percent, finance has shifted from branch counters to mobile apps.

A rewards culture takes hold Cashback, airline miles, and instant discounts have coaxed even cash-comfortable consumers to first use plastic, then digital wallets.

Travel and e-commerce boom Prolific travel and online shopping made card acceptance abroad and on global platforms frictionless; suddenly, the world felt smaller.

Smart regulation paves the way Open-API frameworks and robust tokenisation from the Central Bank delivered secure, seamless payments. Tap-to-pay became ubiquitous almost overnight.

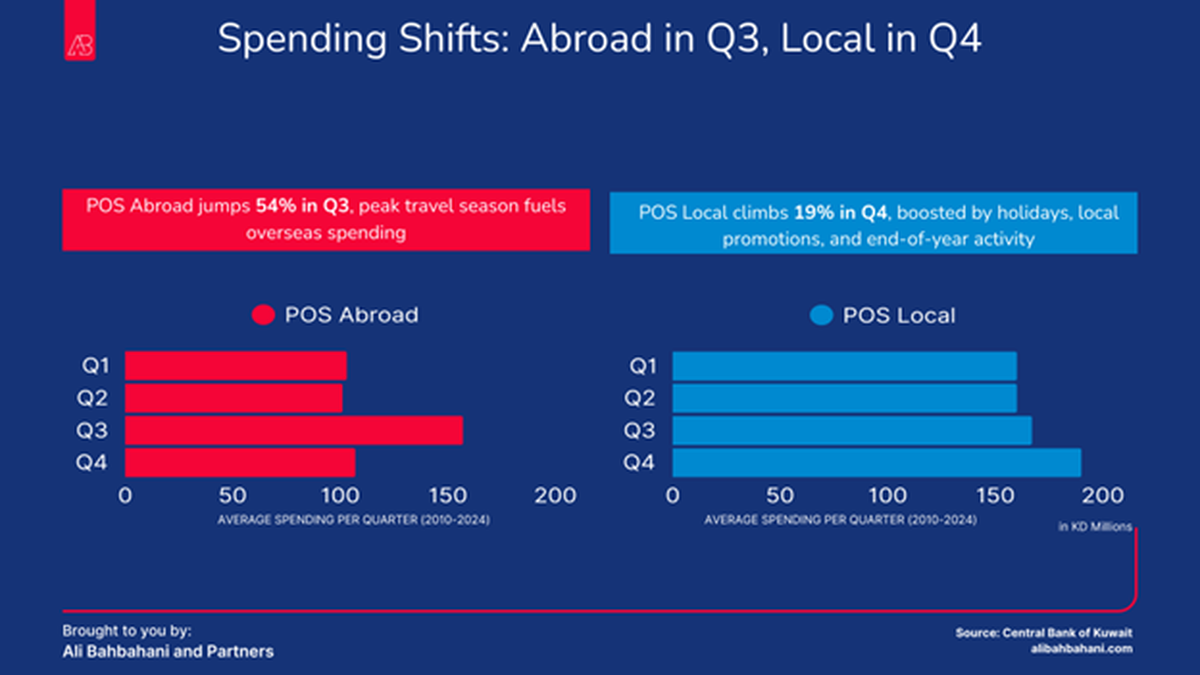

A predictable rhythm

Seasonality is now almost clockwork:

- Summer surge abroad (Q3): overseas card spend rises 54 per cent above the Q1-Q2 average as families decamp for Europe and the Far East.

- Winter shopping frenzy (Q4): domestic card use climbs 19 per cent, fuelled by Black-Friday-style promotions and year-end gifting

Retailers are increasingly aligning their inventory and marketing calendars with these rhythm

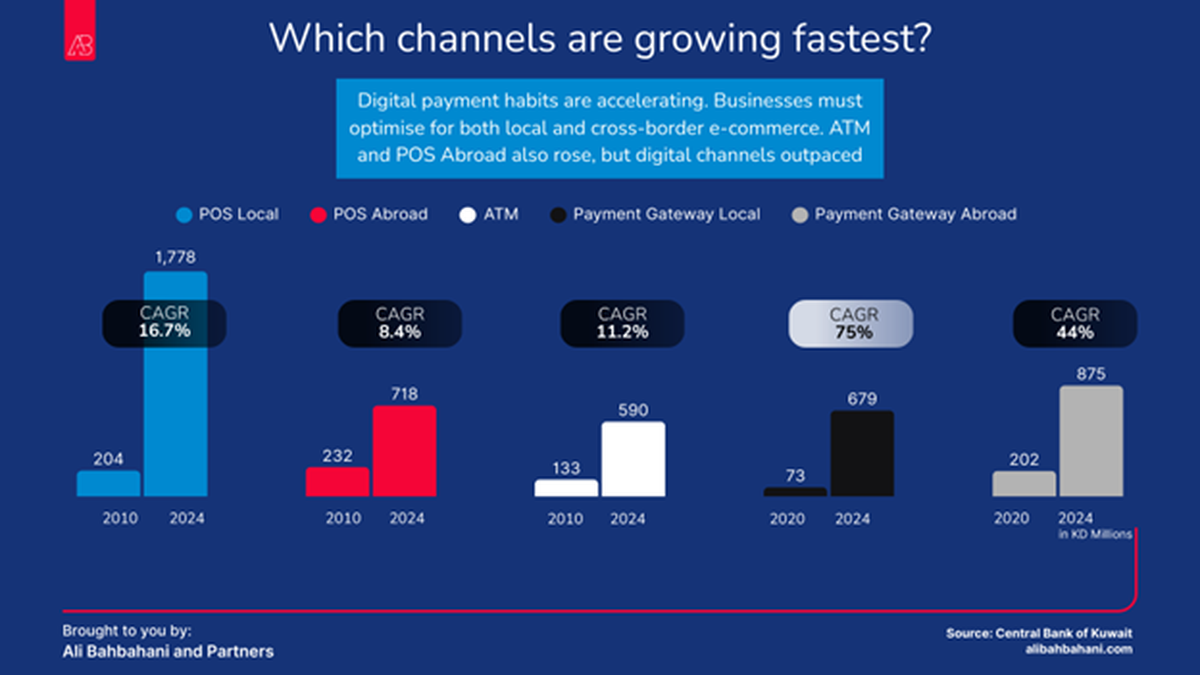

The great digital crossover

‘One in every three dinars is now spent online.’

Traditional point-of-sale spending still leads, at KD 1.78 billion in 2024; yet, the real revolution is online, as payment gateways handled KD 1.55 billion, accounting for 34 per cent of all card spending.

- Local gateways posted a 75 per cent compound annual growth rate between 2020 and 2024.

- Cross-border gateways grew at a rate of 44 per cent per year.

- ATM withdrawals, at KD 590 million in 2024, now account for roughly one-eighth of total card activity.

What does this mean for Kuwait

Businesses should time campaigns to coincide with Q4’s local surge while capturing Q3’s traveler wallet. Banks must pivot from card issuance to lifestyle ecosystems, including embedded finance, app-based instalments, and seamless cross-border services. Government agencies gain anonymised transaction data that supports everything from inflation tracking to urban planning, while furthering financial inclusion.

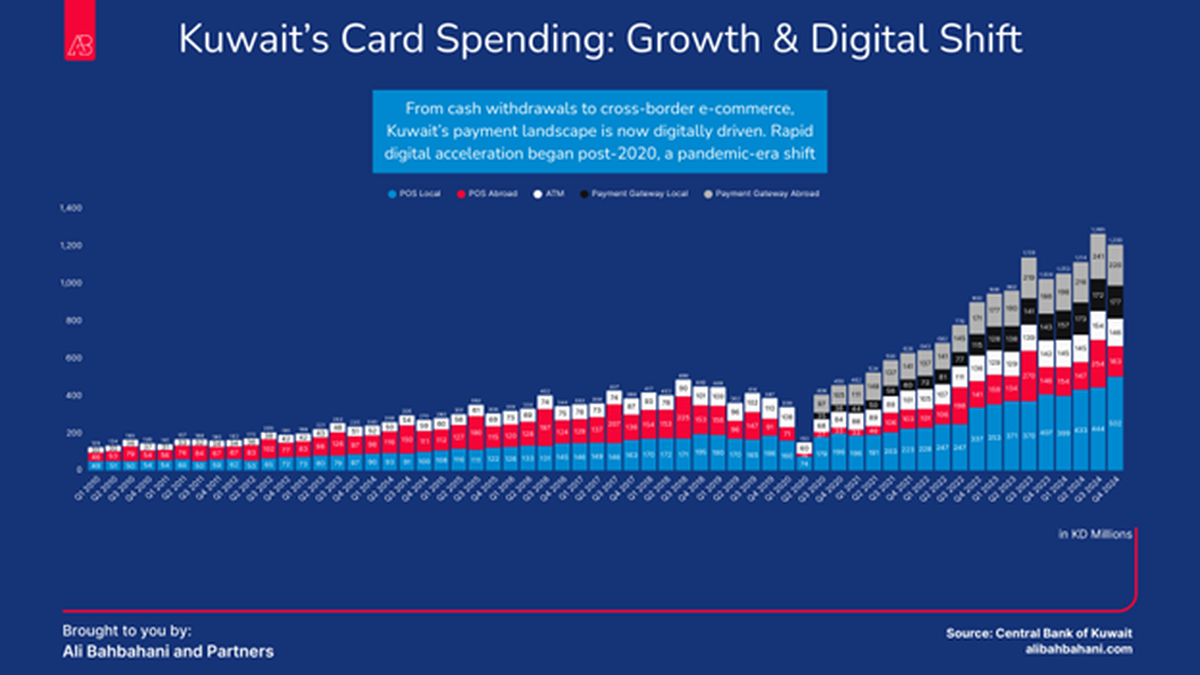

Looking ahead

After 2020, quarterly card spend surpassed KD 1 billion and has maintained that level. Cash will not disappear, yet its share continues to slip.

Winners will treat payments not as a cost centre but as a customer-experience advantage, whether through QR-code payments at a corner grocery or friction-free instalments at a national retailer.

Kuwait’s payment revolution illustrates how rapidly consumer behavior can evolve when technology, demographics, and regulation align. The challenge now is for the broader economy to keep pace.

Ali Bahbahani is the founder of Ali Bahbahani & Partners, a Kuwait-based consultancy specialising in customer experience and digital transformation across the GCC. Further insights at www.alibahbahani.com.

Source: Central Bank of Kuwait, Payment Cards Statistics, 2010-2024

By Ali Bahbahani, Founder, Ali Bahbahani & Partners

Latest News23 hours ago

Latest News23 hours ago

Politics24 hours ago

Politics24 hours ago

Latest News13 hours ago

Latest News13 hours ago

Business22 hours ago

Business22 hours ago

Politics22 hours ago

Politics22 hours ago

Business24 hours ago

Business24 hours ago

Latest News14 hours ago

Latest News14 hours ago

Latest News24 hours ago

Latest News24 hours ago